Some Known Factual Statements About Pvm Accounting

Some Known Factual Statements About Pvm Accounting

Blog Article

The 5-Minute Rule for Pvm Accounting

Table of ContentsLittle Known Questions About Pvm Accounting.7 Easy Facts About Pvm Accounting DescribedLittle Known Questions About Pvm Accounting.Pvm Accounting Things To Know Before You BuyNot known Factual Statements About Pvm Accounting Some Known Incorrect Statements About Pvm Accounting

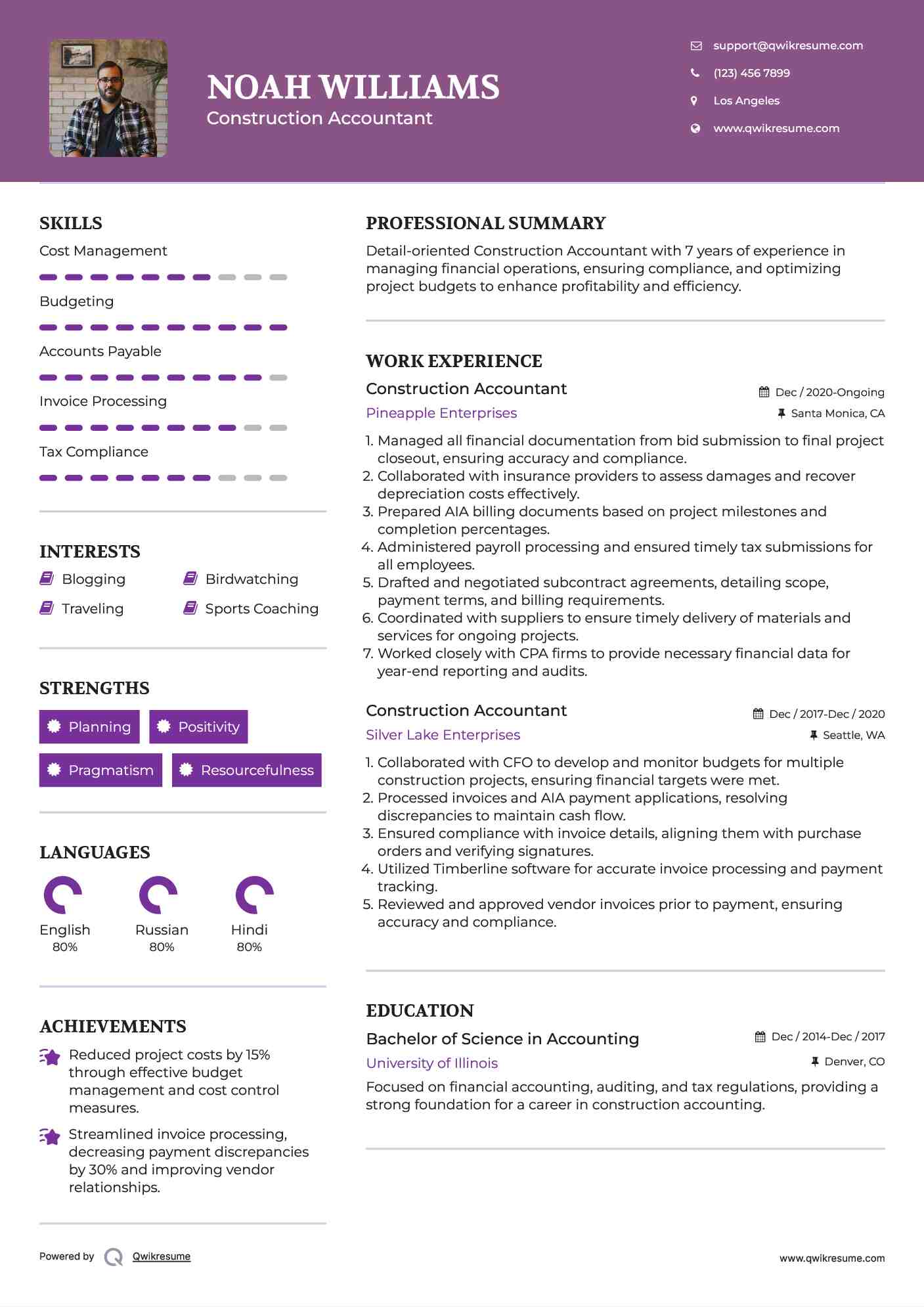

Reporting directly to the CFO, this individual will have complete ownership of the accountancy function for 3 entities, while managing a group of 3+ individuals. It features instructor Joann Hillenbrand, CCIFP who presently offers as the Chief Financial Officer for Airco Mechanical, Integrated. Joann has more than 30 years of experience in construction accountancy and educates students a selection of skills, including: contract management accounting cash money management monetary statement administration construction audit basics construction threat monitoring basics (consisting of insurance policy) The program sets you back $865 to get involved in.Rather, business typically require degrees and experience (i.e. full-time work or teaching fellowships). Building and construction accounting professionals manage financials on tasks and for their business overall. Obligations include: planning/coordinating task financials supervising numerous sorts of financial evaluation (i.e. project cost quotes) assessing economic papers (i.e. invoices, agreements, etc) tracking expenses and earnings assessing (and recognizing methods to address) economic threats, both on specific tasks and those impacting the company in its entirety preparing and sending financial records, both to stakeholders and pertinent governing bodies To end up being a construction accountant, a private should commonly have a bachelor's degree in an accounting-related area.

Not known Facts About Pvm Accounting

Discover more concerning Bridgit Bench, a workforce planning application constructed to assist construction specialists (consisting of building and construction accounting professionals) handle different elements of their work more successfully. Michel Richer is the Supervisor of Material and Product Marketing at Bridgit. He began in the construction sector beforehand with a regional repair company.

A construction accountant prepares financial statements, monitors prices and budgets, and collaborates with job managers and partners to ensure that the companys financial demands are satisfied. A building accountant works as part of the accountancy department, which is in charge of generating economic reports and evaluations. Building and construction accountants might likewise help with pay-roll, which is a type of accountancy.

Our Pvm Accounting PDFs

Proactively dealing with price and operational related matters with task supervisors, possession managers, and other internal project stakeholders on an everyday basis. Partnering with internal project management teams to make certain the monetary success of the company's development jobs making use of the Yardi Work Expense module, including establishing jobs (work), budget plans, agreements, change orders, order, and processing invoices.

Ability to prepare reports and organization communication. Capacity to properly existing information and react to inquiries from groups of supervisors and direct and/or service provider staff members. Digital Realty brings firms and information with each other by providing the full spectrum of data facility, colocation and interconnection remedies. PlatformDIGITAL, the business's worldwide information facility system, gives consumers with a safe and secure information meeting point and a tested Pervasive Datacenter Design (PDx) service approach for powering innovation and efficiently managing Data Gravity difficulties.

Indicators on Pvm Accounting You Should Know

In the early phases of a building service, the company proprietor likely deals with the building accountancy. They handle their own books, look after balance dues (A/R) and payable (A/P), and manage payroll. As a building service and list of projects grows, nevertheless, making monetary decisions will certainly get to past the function of a single person.

For a number of months, and even a number of years, Bob executes all of the vital accounting tasks, lots of from the taxicab of his vehicle. https://www.kickstarter.com/profile/pvmaccount1ng/about. He manages the capital, obtains new credit lines, ferrets out unpaid billings, and places everything into a single Excel spread sheet - construction taxes. As time goes on, they realize that they barely learn this here now have time to tackle new tasks

Quickly, Sally becomes the full-time accountant. When balance dues hits 6 numbers, Sally understands she can not keep up. Stephanie joins the bookkeeping team as the controller, seeing to it they're able to stay up to date with the construction jobs in 6 different states Determining when your building and construction business is ready for each function isn't cut-and-dry.

Pvm Accounting Things To Know Before You Get This

You'll require to determine which duty(s) your service calls for, depending on economic demands and firm breadth. Here's a breakdown of the typical tasks for each function in a building and construction firm, and exactly how they can improve your settlement procedure. Office supervisors use A great deal of hats, specifically in a tiny or mid-sized building company.

$1m $5m in yearly profits A controller is usually in charge of the bookkeeping department. A controller may establish up the audit department (construction taxes).

The building controller supervises of producing accurate job-cost accountancy reports, joining audits and preparing records for regulators. Additionally, the controller is accountable for ensuring your company follow economic reporting guidelines and legislations. They're likewise required for budgeting and surveillance yearly efficiency in connection with the yearly spending plan.

Not known Details About Pvm Accounting

Report this page